Following the disclosure of Dr. Tony Nader and his wife’s offshore company, RajaLeaks reveals another company connected to the Transcendental Meditation (TM) movement leader: Residence Immo Capitale. This business, registered in France in 2007, has come under scrutiny. We translated the official, public French company documents we obtained into English using DeepL. These documents delve into Dr. Nader’s financial dealings, focusing on the ownership structure of Residence Immo Capitale, a real estate firm founded in 2007, and its property transactions, including the real estate located at 5 rue de Tilsit in Paris. They also shed light on the company’s capital contributions, primarily from Dr. Nader and his wife, Velia Lasserre, with their “Princess” daughters later becoming involved in the company’s ownership. The documents suggest that Residence Immo Capitale might be linked to a broader network of financial activities associated with Dr. Nader’s role in leading the TM movement.

An interesting correlation is that Dr. Tony Nader founded both his offshore company and real estate company in 2007, the year before Maharishi’s death. On January 11, 2007, Dr. Tony Nader appointed Jean-Michel NORMAND, a notary public, to establish the real estate company RESIDENCE IMMO CAPITALE. The company is currently managed by co-managers Nicole DELBARRE and Antoine NADER, with its headquarters located in Paris at 102 Avenue des Champs-Élysées.

Tony Nader’s company is involved in the acquisition, through purchase or contribution, ownership, leasing, leasehold, etc. It engages in the transformation, construction, development, administration, and leasing of all real estate or assets. Additionally, it deals with any goods and rights that may function as accessories, annexes, or complements to the aforementioned real estate properties. These activities may be carried out using the company’s own capital, borrowed capital, or by granting guarantees for operations that align with its corporate purpose and contribute to its development, on an ancillary and exceptional basis. In general, the company is involved in all civil operations directly or indirectly related to the aforementioned activities, promoting development without altering the civil nature of the company.

The share capital is set at €1,263,500.00, divided into 100 unpaid shares of €12,635.00 each, numbered from 1 to 100, and distributed among the associates as follows:

- Mr. Antoine Nader was allocated 60 shares numbered 1 to 60,

- Mrs. Vélia CAVANNA was allocated 39 shares numbered from 61 to 99,

- and Mr. and Mrs. Pierre LASSERRE were allocated 1 share numbered 100.

Mr. and Mrs CAVANNA family members of Tony Nader’s wife Velia LASSERE.

Jessica Kelty, Tara Gronberg, Velia Lasserre - the Palm Beach Day Academy "FEATHER BALL" Benefit Dinner, Friday, April 10, 2015.The company’s first significant real estate transaction took place on 8 April 2008 when it acquired various properties and rights to a building at 5 rue de Tilsit, Paris, for €3,900,000. To finance the acquisition, Nader’s Company borrowed the sum of THREE MILLION NINE HUNDRED THOUSAND EUROS (€3,900,000) from UBS Bank.

Dr. Tony Nader invested a significant amount of cash, amounting to 758,100 euros, into the company. His business partner, Mrs. Velie CAVANNA, contributed 492,756 euros and an additional 12,635 euros in cash, making the total investment in the company 1,263,500 euros.

The significance and role of cash in offshore companies – we emphasize that Tony’s company is not an offshore company – can vary, but generally, offshore entities may use cash for a variety of purposes. Here are a few considerations:

- Confidential Transactions: Offshore companies often deal with international transactions, and cash can facilitate confidential and swift transactions, avoiding the scrutiny that electronic transfers might attract.

- Asset Protection: Holding cash allows offshore entities to maintain liquidity and act quickly in response to opportunities or challenges. It also provides a means of holding value in a stable form.

- Tax Efficiency: Offshore jurisdictions are sometimes chosen for their favorable tax regimes. Cash reserves can be managed strategically to optimize tax efficiency and reduce the overall tax burden.

- Investment Opportunities: Offshore companies may use cash to invest in various assets globally. These investments can include stocks, bonds, real estate, or other financial instruments, contributing to portfolio diversification.

- Operational Flexibility: Cash provides flexibility in day-to-day operations, enabling offshore entities to cover expenses, seize business opportunities, or navigate economic downturns without relying heavily on external financing.

- Crisis Management: Having a significant cash reserve can be crucial for offshore companies during economic downturns or unexpected crises. It provides a financial cushion to weather uncertainties and continue operations.

- Avoiding Banking Regulations: Offshore entities may prefer holding cash to circumvent certain banking regulations and restrictions that could impact their financial activities.

The company’s properties and property rights include, among others, the following items within the real estate assets and rights located in PARIS (75007), specifically at 12-14 Rue d’Estrées and 22 Avenue de Breteuil:

- Parking space number 15 in the basement,

- And fifty-nine/tenths thousandths (59/10000) ownership of the land and general common areas,

- Cellar number 4 on the first floor,

- And eight/ten thousandths (8/10000) ownership of the land and general common areas,

- A four-room apartment, number 8, on the third floor opposite, comprising: entrance, living room and balcony, kitchen, storeroom number 21, toilet, shower room, bathroom, bedroom 1, bedroom 2, bedroom 3, and balcony,

- And six hundred and ten thousandths (600/10000) ownership of the land and general common areas.

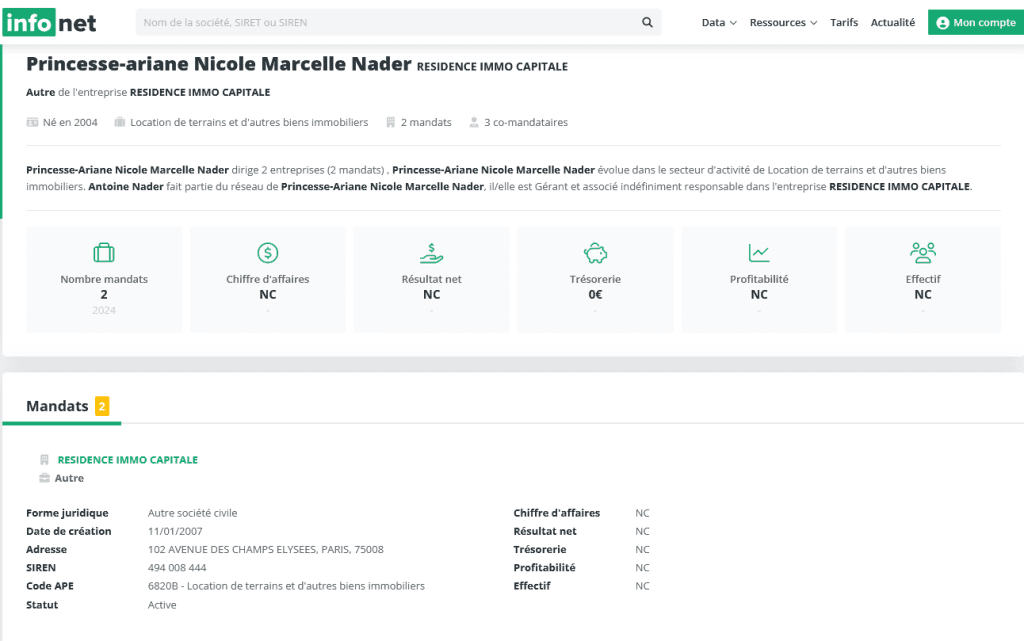

According to the available 2023 offical company documents, Dr. Tony Nader’s two daughters, Princesse-Ariane Nicole Marcelle NADER and Princesse-Catherine NADER, have appeared among the company’s ownership circle, each holding 15 shares in the company.

It is interesting to note that the company documents mention princesses Princesse-Ariane Nicole Marcelle NADER and Princesse-Catherine NADER who are the daughters of the Royal Nader couple. this makes sense because according to the Global Country of World Peace, Tony is the king of the country and therefore his daughters are princesses.

Now, when you register a company, the lawyer or the recorder is viewing, your official, passport or IDs, in order to check your names that will appear in the company documents. this implies that Tony Nader’s two daughters are in fact called princesses on their IDs, otherwise, how can the princess title be included in a company document that is submitted to a business court?

So here we have Tony and his wife promoting at least in a legal way the idea that their daughters are in fact princesses. Of course, perhaps French law allows princess to be used as a first name, but we assume the Maharaja who wears a golden crown and sits on a golden throne, and is a king of a country would name his daughters princesses, and this is the title. I don’t know the child psychology of this, but I wonder when his daughters are grown-up and have their own lives what kind of affect it had on their childhood? Or perhaps, Tony is expecting his fake country to succeed, and actually form a real country, somewhere in the world? This may be another interpretation. What do you think? What do parents think who read this? What do child psychologist think about this state of affairs? We wish to hear your opinion, please write us.

Here are the 71 pages of Tony Nader’s company public documents compiled and translated into English using DeepL.

Google’s NotebookLM artificial intelligence helped us with our analysis, and the transations were found by it.